SHOULD YOU INVEST IN WATCHES?

A BEGINNERS GUIDE

The current buzz among watch enthusiasts centres on strategies for profiting from the buying and selling of select models. With poor interest rates reducing the return of low-risk investment and savings opportunities such as ISAs and Premium Bonds, astute investors are looking for alternative opportunities to grow their wealth.

With cryptocurrency, index funds, domestic share-trading platforms, and other modern investment solutions taking the spotlight, many individuals are questioning the investment quality of wristwatches now more than ever. In an effort to provide clarity, I’ve crafted this guide to outline the various categories within watch investment. Additionally, I’ll highlight the key factors to consider for each category and discuss the associated risks.

This is rather a ‘hot topic’ within the watch enthusiast community, with firm opinions on both sides of the argument. In any event, I want to preface this article with the usual disclaimer: This is not financial advice. That said, while there are some ground rules when it comes to buying, it’s undoubtable that most vintage watches, once they’ve reached the bottom of their depreciation curve and demonstrated some steady growth, will make safe, reliable, predictable and (arguably) most importantly, enjoyable investments.

Furthermore, you don’t have to pay any capital gains tax (CGT) on funds earned through the appreciation of any watch while it’s in your possession. Take that, property investors!

What is an ‘investment watch’...and what isn't?

Investing is defined as the action or process of allocating money with an expectation for future profit – that’s simple enough, isn’t it? Therefore, an ‘investment watch’ must be a timepiece that, once bought, is expected to increase in tradable value over a period of time. So, the term insinuates that either you will sell the watch at some point, or if you ever need to free up money, the watch needs to be a relatively liquid asset.

While there are plenty of high-value watches out there, not all of them qualify. Antique pocket watches, diamond-covered dress watches and heavily-patinated WW1 pilots watches are all examples of pieces which may have a theoretical high value. However, interest may not be there when it comes to selling said pieces. To continue with that theme, it’s important to note that great watches are not always investment watches. This is especially true when it comes to modern watches that haven’t had a chance to go through their most significant period of depreciating value and where the brand behind the watch isn’t a proven long-term hit in terms of value retention.

Investment watches are defined by a specific set of qualities and characteristics that don’t necessarily fall in line with the criteria that make a great watch in 2024.

Image: An example of an excellent watch that fails to make a good financial investment – the Grand Seiko SBGN003. If you’d like one, buy it pre-owned.

Are watches a good investment?

Luxury watches, both old and new, have long been revered not only for their exquisite craftsmanship but also for their potential as lucrative investments. The allure of investing in watches lies in their undeniable potential for appreciation.

Over the years, many wristwatches have witnessed a remarkable increase in value, making them a coveted long-term investment. Unlike traditional assets like stocks and bonds, vintage watches offer a level of stability and resilience against market volatility, presenting a compelling option for investors seeking a more conservative approach to investment. Certain luxury brands, such as Rolex, Patek Philippe, Audemars Piguet, Omega, Cartier, and Breitling, are renowned for their ability to retain value over time. Others have the potential to yield truly impressive returns.

According to the Knight Frank Luxury Investment Index, watches boast an impressive average return on investment (ROI) of 147% over a decade, positioning them as the second most lucrative asset class, surpassed only by wine and rare whiskey.

Take the Rolex Daytona, for instance, a chronograph watch that made its debut in the 1960s. Over the past few decades, its value has soared remarkably. Initially priced at around $200 in the 1960s, today, a Daytona can command prices upwards of $20,000 at auction, with certain rare models fetching millions. Such substantial appreciation is undeniably tempting for savvy investors.

The benefits of investing in watches

Still unsure about adding watches to your investment portfolio? Let’s delve deeper into the compelling benefits they offer beyond just their aesthetic appeal:

- Flexibility: Unlike real estate or other long-term assets, watches offer a high level of liquidity, allowing investors to quickly convert them into cash when needed. Whether through reputable dealers, prestigious auction houses, or online marketplaces, selling luxury watches can be easier and more lucrative than you might think.

- Diversification: Investing in watches allows you to diversify your portfolio, mitigating the impact of market volatility and inflation. Tangible assets like watches often maintain their value, even during periods of economic uncertainty. Additionally, they can serve as a hedge against currency fluctuations, as their prices are denominated in Swiss francs, euros, or US dollars, depending on the brand and market.

- Potential Profitability: The best investment-grade watches tend to appreciate in value over time, offering the potential for substantial profits. Unlike luxury cars, which typically depreciate, high-quality timepieces can increase in value, allowing you to wear your favourite sports watch daily and potentially sell it for a profit later on. Notably, luxury watches priced over $100,000 are projected to appreciate by an average of approximately 69% every decade.

- Stability During Economic Turmoil: Watches exhibit little to no correlation with the stock market, making them a stable investment option, especially during economic downturns. For instance, while the value of luxury watches dropped by only 8% during the COVID-19 pandemic in 2022, the S&P 500 stock index experienced a more significant decline of 19%.

- An Investment You Can Wear: Beyond their financial benefits, watches are tangible assets that you can wear and enjoy every day. While stocks may plummet and assets fluctuate, your cherished wristwatch will remain a steadfast reminder of the sheer joy it brings with every tick on your wrist.

Do watches go up in value?

Investors often ponder whether watches have the potential to appreciate in value over time. Unfortunately, there is no definite answer to be found. A watch’s investment value is nuanced, depending on many factors, including the brand, model, condition, and market trends.

In today’s uncertain economic landscape, the allure of luxury watches as investment vehicles has only grown stronger. Discerning investors are increasingly turning their attention to the luxury watch market, recognising its potential for generating significant returns. This trend is underscored by the robust growth of the luxury watch market, which surged to $42.2 billion in 2022 and is projected to reach $63.6 billion by 2032, at a Compound Annual Growth Rate (CAGR) of 4.5% during the projected period.

Luxury watches, particularly those from esteemed brands with price tags exceeding $15,000, are often perceived as sound investments. These timepieces tend to retain their value well and may even appreciate over time, making them attractive assets for investors seeking long-term growth opportunities. Additionally, many vintage or limited-edition models can be considered prime investments due to their rarity and heightened demand among collectors.

However, before diving head first into the fascinating world of watch investing, it’s crucial to acknowledge a vital caveat: not all watches appreciate in value. In reality, the majority of watches are susceptible to depreciation, particularly if they are mass-produced, low-quality, or damaged. Some industry experts suggest only 20% of luxury watches sold end up as profitable investments.

Only select models from reputable brands warrant consideration as investment-worthy assets. Certain brands and models consistently outperform the overall market, but identifying them requires thorough research. Additionally, trends and unexpected factors can influence the value of watches, adding an element of unpredictability. As such, it’s prudent to approach watch investment with a mindset that prioritises passion over profit alone. After all, true appreciation for your timepiece transcends mere financial gains.

What are the best watches to invest in?

Defining which watches are and aren’t to be classified as investments is often subjective. This is because the levels of favourable characteristics associated with good investment watches aren’t particularly quantifiable – especially the more subjective ones like timelessness in design. To help better define the criteria, here are the three groups of genuine investment watches:

Group 1 – modern superstars

The first group is made up of fairly modern watches. The general characteristics of these pieces are as follows:

- Watches that are currently available to purchase from retailers and authorised dealers or watches that have been available (brand-new) through primary retailers in the last 5-10 years.

- Watches that are selling on the secondary (reseller & grey) market for above the list retail price.

To put some examples to this criteria, I’m mainly talking about modern sports watches such as the current Rolex Cosmograph Daytona 116500LN, the now-discontinued Rolex Submariner 116610LV ‘Hulk’ and discontinued Patek Philippe Nautilus models like the 5980/1A-019. Watches like these have never been available for below retail and, if discontinued by the brand, have continued to sell for more than the retail price since their discontinuation.

This investment category isn’t exclusive to £5,000+ watches. Early in 2020, we saw the Tudor Black Bay 58 Blue trading for around £4,000 on the secondary market in the months following its launch. Those that were able to buy the watch for the retail price of £2,760 made good returns when moving their watches on during that lucrative 3 month period of low supply and high demand. To go even lower on the price scale, we recently saw the quartz Timex Q Re-issue trading on eBay and Chrono24 for 2x, and even 3x its £150 retail price following its highly successful re-release.

The reason that these modern watches are able, or have been able, to trade on the secondary market at high markups is due to the imbalance of high demand for the watches and the low production levels that the brands decide/are able to produce watches at. There are huge profits to be made from A) the resale value of hard-to-get, current production watches and B) the surge in demand when a ‘hot’ model is discontinued.

The first few factors that make this method of investing fairly high-risk are the uncertainty of if/when brands will increase the supply of current watches, release new watches and, most importantly, discontinue old watches. For example, once both Timex and Tudor models had been in production for more than two months, secondary market prices dropped to below or equivalent to the retail price as more and more consumers were able to purchase the watch at retail due to an increase in production/retail availability.

In relation to the higher-end, modern investment pieces, the risk comes from timing your purchase and sale. Yes, if you can get a steel sports watch at retail price from Rolex, Patek Philippe or Audemars Piguet, as long as you sell the watch shortly after its discontinuation or during its production, you’re almost guaranteed to make a sizable return on your investment. The constrictive factor with this route is the extreme difficulty of getting hold of said waitlisted watches at retail price. More often than not, Authorised Dealers will only sell these high-demand pieces to clients who already have a large purchase history with them, meaning a new customer is unlikely to ever be allocated the ‘hottest’ models.

Image: The AP Royal Oak Ref 15202BC.OO.1240BC.01 – While this elusive White Gold AP retails for a modest £56,700, the watch regularly sells for twice that on the secondary market. (Credit – Audemars Piguet).

The next potential hurdle to profiting from the higher-end part of this category is the variation in prices of ‘hot’ watches from the aforementioned brands, which makes it tough to know when to buy or sell. Take the aforementioned Rolex Hulk – a watch that retailed in Rolex ADs from 2010-2020 for £6,500-£7,500 and that sold on the secondary market for around £10,000. In the weeks following its discontinuation in September 2020, the Hulk’s resale value shot up to as much as £25,000. Those who bought into the watch during the progression or peak of this hype, believing that this upward curve would continue, have since been disappointed to see the watch slowly decline to a value of around £16,900 as of this week. While it’s likely that the price will begin to rise again one day, when this will be is simply a gamble.

The situation is further complicated by professional secondary market dealers allegedly holding casefulls of what are perceived to be ‘hard to buy’ watches in order to starve supply and create artificially inflated prices. A further complication is the matter of aesthetic longevity – will bright-green, 40mm sports watches still be in fashion in 5+ years?

Image: Questionable activity from a well-known online dealer.

Then there’s the popular pastime of buying and selling these pieces short-term, or ‘flipping’ as it’s been coined. This is a dangerous game as a lack of case stickers, spare links and supporting documentation or minor scuffs often result in a 4-figure value loss. The upshot of this is that you won’t want to risk wearing these types of investment watches, limiting the enjoyment that can be had from ownership.

So, there’s my classification of the ‘Modern Superstar’. I’m not saying all watches have to and will depreciate before they become bullet-proof long-term investments. Still, history has taught us that it’s generally safer to wait out industry trends before investing in high-value watches long-term. Watches from brands such as Panerai and Franc Muller have suffered a decline in secondary market value since their media-declared investability in the early 2000s. The cause of this is widely regarded to be a result of a decline in both brand awareness and the popularity of the large case sizes that the brands tended to produce.

Group 2 - vintage grails

The next group of investment watches is far easier to define. These are watches that:

- Are old enough to have gone through a depreciation slump.

- Are objectively rare due to low production numbers, condition, or due to historical significance.

- Are generally produced by brands that continue to/resultantly play large roles in today’s watch industry.

Essentially, these are the watches whose market-topping prices and long-term investability are justified and secured by the great stories behind them and/or the role that they play in horological history.

Examples of such watches that are rare due to their historical richness include the early series Omega Speedmasters. Affordable watches ten years ago, early models have risen exponentially in value and are now widely recognised as one of the top 5 most significant watches in history. Featuring the Calibre 321, certain examples in varying condition can be found at auction from £80,000 to £195,000. One of the benefits of investing in vintage watches from manufacturers who are still thriving is the continued public awareness that is the result of the 7-figure marketing and R&D spending of the current top brands. For example, after an elaborate scanning process of the original, widely-appreciated 321 Calibre, Omega re-released the movement in a modern Speedmaster, increasing awareness and demand for the original models.

Another example of investment pieces that highlight key moments in horological history is the double-stamped watches that have been produced as a result of the 170-year-long relationship between heritage jeweller Tiffany & Co. and Patek Philippe. In 1851, Tiffany & Co. became the first retailer in America to sell Patek Philippe watches. Ever since, a handful of co-signed Patek watches have been sold by the iconic, New York-based jeweller every year. On the rare occasions that 19th and 20th-century Tiffany & Co-stamped Patek Philippe watches have come to market over the last few years, simple 3-hand Calatravas have sold for around £100,000, with the more complicated models topping £1,000,000. The fact that both of these heritage brands continue to captivate their prospective customers while maintaining a high public image means that these vintage watches are surefire future growers regarding value.

Image: A 1963 Tiffany & Co signed Patek Philippe Ref 2523/1 that sold at auction in 2017 for £1.5 million (Credit – Phillips).

Incidentally, while Swiss ‘Vintage Grails’ are pretty well out of reach for those with a budget of less than £15,000, there are a small number of vintage Japanese watches that also fit the ‘Vintage Grail’ criteria, and that can offer similarly reliable financial returns over a long-term investment to their pricey, Swiss group-mates. One such example is the early 1960’s Seiko dive watches. The Seiko 6217 or ‘62MAS’ was the genesis of all Seiko Dive watches. Its functional and unique design language is visible in almost all of the highly popular Seiko dive watches that have succeeded it. Due to the limited number of examples still in excellent condition and the ever-growing enthusiasm surrounding Japanese dive watches, prices have begun to reach levels that would have been unthinkable ten years ago. While proving extremely difficult to find, examples of the 6217 can be had for around £5,000 in pristine, unrestored condition. It wouldn’t be surprising to see good examples of iconic 60s Seiko dive watches pushing £10,000 over the next five years.

Image: A 1969 Seiko 6159-7001 in mint condition. Priced at £6,100 (Credit – Analog/shift).

While far less dynamism and exact timing is required to successfully invest in comparison to ‘Modern Superstars’, ‘Vintage Grail’ watches share the aforementioned group’s disadvantage of low wearability – again, the value of these watches is often heavily dependent on condition. This point in combination with the fact that the bulk of these watches cost more than £50,000 means that you’re not likely to want to wear and use watches in this category, potentially reducing the enjoyment aspect of ownership. This brings us on to the 3rd and final category of investment watches.

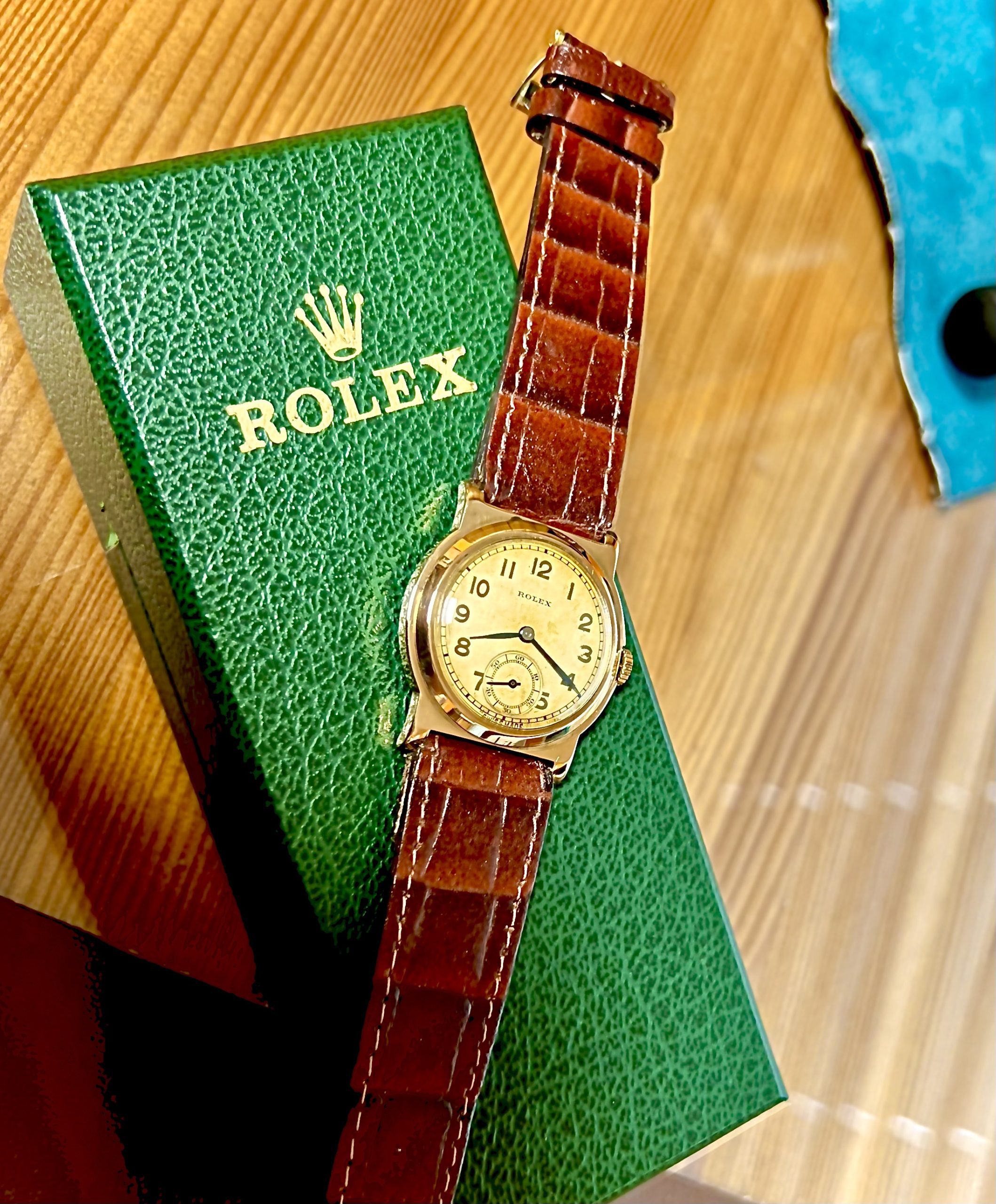

Group 3 - vintage classics

For many, this group of investment watches manages to solve the wearability and high cost of entry issues thrown up by the first two categories. The criteria may seem similar to that of ‘Vintage Grails’; however, there are several key differences. We define ‘Vintage Classics’ as watches that:

- Are old enough to have gone through a depreciation slump.

- Feature classic, timeless designs that are not subject to changing style trends OR watches with designs that epitomise an iconic and retrospectively admired design era.

- Are made from long-lasting materials and feature reliable, widely-serviceable movements.

- Are produced by brands that continue to play large roles in today’s watch industry.

- Are in good condition.

Examples of watches that fit these criteria are plentiful. Brands such as Omega, IWC, Jaeger-LeCoultre, Breitling, Heuer and Zenith are all good options having produced a range of watches featuring timeless, trend-defying designs. This means that the watches have un-offensive, elegant dials and that the cases are not too small or too large for the average man’s wrist – generally 34mm to 40mm.

To expand on the ‘depreciation curve ’, the majority of ‘Vintage Classics’ must have been produced before 1990 so as to ensure that their value has become stable and free from negative variance. The exception to this rule is sub-£20,000 Rolex watches featuring an Oyster case produced before 2009. In my opinion, these 5-digit reference models under £20,000 are also safe bets when bought in good condition. The reasoning behind why it’s good to stick to popular brands when investing in vintage watches is a combination of ensured added value, due to brand status once the time comes to sell the watch and the fact that the majority of movements used by these reputable, Swiss brands are still serviceable with OEM replacement parts that are widely available. This ensures the watch’s longevity in function and, therefore, value.

The first factor that hints towards continued growth in value for watches in this category is the global increase in popularity and enthusiasm towards vintage watches. You only have to look at the growth over the past 15 years in the number of dealers specialising in vintage watches, the expansion in vintage watch press such as Hodinkee and the global news coverage of major auction events such as the record-breaking sale of Paul Newman’s Rolex Daytona in 2017 to see the current extent of global interest.

Following that, many would agree that a large part of the allure of vintage watch ownership and the ‘bond’ between a watch and its owner is born in research and becoming aware of the rich history that vintage watches are part of. The widespread use of the internet has been a massive enabler in allowing millions of people to access information about vintage watches that was previously confined to rare books, ageing experts and brand archives. Anyone can now use the wealth of knowledge available from forums, videos, blogs, marketplaces and journals as a pathway towards getting into the hobby. The natural supply/demand formula dictates that this increase in demand and the definitive limit to the supply of good quality vintage watches will increase value at every level.

Additional factors supporting the long-term investment potential for affordable vintage watches are the significant increase in the price of gold (of which many vintage watches are made), the increased popularity of vintage-inspired modern watches and the social changes in favour of sustainability and reducing carbon emissions from fast-fashion.

The main benefit of investing in a ‘Vintage Classic’ from a financial perspective is a considerable reduction in risk due to the trend-proof nature of the asset’s value. Rather than regular fluctuations, you’re likely to see steady, reliable growth with no limitations of when to sell or when to buy. From an ownership or enthusiast perspective, this means you’re able to own and hold onto the watch as long as you’d like to. Furthermore, ‘Vintage Classics’ tend to be far more wearable watches. This is because their appreciating value is not so heavily dependent on them being in pristine condition. This point can be further backed up by the fact that many ‘Vintage Classics’ are available at far more affordable price points in comparison to ‘Vintage Grails’. To put numbers on this claim, the 60s, 70s, and 80s Omega Seamasters in Yellow Gold can currently be found for under £4,000, with steel, 3-hander IWC, Rolex Oyster and JLC watches available for around £2,000.

Image: A 37mm 1971 Omega Seamaster in 9ct Yellow Gold – £3,950.

The gradual increase in the cost of vintage watches over the last decade shows that there’s generally no ‘peak time’ to sell, rather only when you require the funds to become released from the investment. This category of investment watches can also be worn and enjoyed without fearing large value decreases. As a result, many investors/collectors choose to hold onto their investment pieces, often developing a deeper connection with them. If these ‘assets’ are never needed to be liquidated by the owner, investment watches make great family heirlooms. Passing on watches to children or grandchildren at any time can offer a wonderful reminder of memories, passions and personal style, but also a potential safety net of appreciating financial support in times of need.

Additionally, while we’d never condone tax evasion, appreciating valuable assets, such as vintage watches, can assist in a number of legal ways of minimising the cost to families when it comes to inheritance tax. Here is an informative guide that outlines the rules of inheritance tax as well as how small, tangible assets can be useful.

Maximising your returns: tips for investing in luxury watches

Investors are primarily driven by one goal: achieving a lucrative return on their investments. However, predicting market price developments with absolute certainty is impossible. Nonetheless, certain criteria can enhance the likelihood of achieving success and coming out as a “winner”.

Here are some factors to consider when purchasing a watch as a value investment.

- Check for Authenticity: Authenticity is paramount when investing in a vintage watch. Ensure you buy from a reputable dealer who has already authenticated the watches, such as VGW, to guarantee you purchase a genuine timepiece.

- Originality of Key Components: Pay close attention to the originality of key components such as the dial, case, and movement. Original components significantly impact the value of the watch, so verify their authenticity before making a purchase.

- Condition: The condition of the vintage watch is crucial in determining its value. Look for watches in excellent condition, as they typically command higher prices, especially if key components are original.

- Simplicity Holds Its Value: For beginners, consider investing in a simple time-only watch rather than something too complicated. Simpler models often hold their value well and are easier to resell in the future.

- Buy the Seller First: Prioritise buying from a reputable and reliable seller. Research the seller’s reputation, customer reviews, and authentication practices to ensure you’re dealing with a trustworthy source.

- Think About Security: Consider how you will store and protect your vintage watch once you’ve acquired it. Investing in a secure storage solution, such as a safe or safety deposit box, can help safeguard your valuable timepiece.

If It’s Too Good to Be True, It Probably Is: Exercise caution and trust your instincts. If a deal seems too good to be true or the price is significantly lower than market value, it could be a sign of potential issues with authenticity or condition.

Find your next investment watch

So, to quickly sum up the categories that I’ve highlighted: ‘Modern Superstars’ are the hype-fuelled, fast-moving commodities, ‘Vintage Grails’ are the super-rare, horological treasures that the brands want to buy back, and ‘Vintage Classics’ are the interesting, safe, approachable investments – accessible yet lucrative.

Whether it’s paying for sporting season tickets, travel, motoring or even online gaming, passions and interests can often be costly across the board. With this in mind, it’s clear that one of the great bonuses that comes with watch ownership is the scope for one’s interest and hobby to become profitable.

From their potential for appreciation to their flexibility as assets, watches offer investors a unique opportunity to combine passion with profit. Whether you’re a seasoned collector or just starting your journey into watch investments, understanding the market dynamics and key considerations can help you make informed decisions.

When you’re ready to find your first or next investment, browse our collection of vintage watches or sign up for our newsletter to be the first to know of new stock.

OTHER BLOGS