ARE VINTAGE ROLEX WATCHES

A GOOD INVESTMENT?

Rolex stands as an iconic emblem of luxury, revered worldwide for its craftsmanship, precision, and enduring style. Yet, beyond its obvious intrinsic allure, are vintage Rolex watches really a good investment?

With Rolex’s unparalleled reputation, it’s no surprise that vintage models often command staggering prices at auctions and on the resale market. The allure of owning a piece of iconic horological history coupled with the promise of potential financial gain makes vintage Rolex watches an enticing prospect for collectors and investors alike.

Rolex watches have consistently proven their worth as investments over the years, with values steadily climbing and often outperforming other luxury watch brands. Since 2019, the price index of some of the most popular Rolex models has risen by a staggering 42%. However, like any investment, there are plenty of nuances to consider. The condition of the watch, rarity, and model all play pivotal roles in determining a wristwatch’s true investment value.

In this article, we delve into the world of vintage Rolex watches, exploring their investment potential, factors influencing value, and tips for making informed investment decisions. Whether you’re a seasoned collector or a novice enthusiast, understanding the intricacies of vintage Rolex investments can guide you towards finding a timepiece you love while still making a sound investment decision.

Should you invest in a vintage Rolex watch?

Rolex has emerged as the undisputed champion in the realm of luxury timepieces. With glowing endorsements from experts and memorable appearances in acclaimed films, Rolex is one of the few brands that has managed to transcend its role as a mere producer of quality timepieces to become a cultural icon of unparalleled stature.

Over the past two decades, this widespread admiration has propelled vintage and second-hand Rolex prices to soaring heights. Rolex is already the ultimate aspirational watch for the young, modern executive and the recent pandemic brought a surge in demand for modern sports watches. This has only bolstered the value of vintage Rolex timepieces to greater heights.

Central to Rolex’s allure is its rich history of craftsmanship, innovation, and unwavering popularity among collectors and enthusiasts alike. From accompanying explorers on historic expeditions to adorning the wrists of iconic figures like James Bond, Roger Federer, and Sir Winston Churchill, Rolex watches have woven themselves into the fabric of both cultural and horological history. This legacy not only enhances the brand’s prestige but also contributes significantly to the investment value of vintage Rolex watches.

The consistent demand for vintage Rolex watches in the market highlights their enduring appeal as investment assets. Trends indicate a steady increase in value over time, with specific models such as the Datejust and the Day-Date serving as prime examples of solid investments that have appreciated significantly. Iconic models like the ‘Paul Newman Daytona’ and the Rolex GMT-Master Pepsi have become synonymous with high returns for savvy collectors.

Market research further bolsters the case for vintage Rolex watches as lucrative investments. In 2023, the worldwide pre-owned luxury watches market boasted a value of £18.45 billion, with projections indicating a steady compound annual growth rate (CAGR) of 9.2% from 2024 to 2030. According to other reports, from 2011 to 2021, vintage Rolexes appreciated more than gold and real estate.

It’s worth noting, however, that Rolex prices experienced a peak in 2022 during the height of lockdowns, resulting in unnaturally high prices. Despite this, vintage Rolex watches remained relatively stable compared to their modern counterparts, which witnessed a feverish demand for sports models like the Daytona and Patek.

Why are vintage watches good investments?

Vintage watches hold a unique allure and are widely regarded as sound investment opportunities for a variety of reasons. Here are some key factors that contribute to their appeal:

Historical significance and rarity

Vintage watches often boast rich histories and are imbued with a sense of nostalgia and authenticity. Their rarity, stemming from limited production runs or discontinued models, adds to their allure as coveted collector’s items.

From the Omega Speedmaster’s lunar legacy to James Bond’s iconic Rolex Submariner, vintage watches carry with them tales of adventure, innovation, and style. Each timepiece encapsulates a unique chapter in horological history, representing not only a functional accessory but also a tangible piece of heritage and craftsmanship.

Potential for value appreciation

One of the most compelling reasons to invest in vintage watches is their potential for value appreciation over time. Unlike many consumer goods that depreciate in value, well-maintained vintage watches often increase in worth as they become rarer and more sought after by collectors. This makes them not only cherished collector’s items but also a sound financial investment.

Tangible assets and hedge against inflation

Vintage watches represent tangible assets that hold intrinsic value, offering a hedge against inflation and economic uncertainty. Unlike paper-based assets, whose worth may fluctuate based on market conditions, vintage watches are liquid assets of exceptional value. Rolex watches have even been used as a form of currency in times of crisis or instability – something you could barter with should you ever find yourself in trouble.

Emotional connection and collectibility

Beyond their monetary value, vintage watches often evoke strong emotional connections and are prized for their collectibility. Watch enthusiasts often develop a deep appreciation for the craftsmanship, design, and history behind each timepiece, leading to a passionate and dedicated community of collectors. The desirability of vintage watches extends far beyond just the financial considerations, with many individuals drawn to the status and prestige associated with owning these coveted pieces.

An investment you can wear

One of the unique appeals of investing in vintage watches is the ability to wear and enjoy your investment on a daily basis. Unlike traditional investments such as stocks or bonds, vintage watches provide a tangible and functional way to show off your investment.

Safe buying compared to paper-based assets

Investing in vintage watches offers a level of security and stability akin to traditional safe-haven assets like gold, art, or jewellery. With proper authentication and documentation, vintage watches give investors confidence in their acquisitions’ authenticity and provenance. This tangible aspect of ownership, combined with the enduring appeal of vintage timepieces, appeals to investors looking to diversify investment portfolios.

Vintage Rolex watch prices

Vintage Rolex watches encompass a wide spectrum of models spanning several decades, each with its own unique characteristics and price range. While pinpointing an exact price range can be challenging due to the multitude of factors influencing value, we can provide a general overview of vintage Rolex watch prices to offer insight into the market.

At the lower end of the pricing scale, affordable vintage Rolex models such as the Oyster Perpetual Date and Oysterdate can be found starting at around £2000. Similarly, vintage ladies’ Rolex watches crafted in gold typically start around the £2000 mark and increase in price based on factors such as condition, rarity, and model.

Moving up the price ladder, popular vintage Rolex models often fall within the range of £3000 to £10,000. Buyers can find iconic models such as the Datejust within this range, representing a solid and safe investment option. Steel Datejust watches, in particular, are highly sought after, with prices typically beginning at £3,500 to £4,000 and increasing based on factors such as age, condition, and configuration.

However, it’s essential to recognise that vintage Rolex watch prices can vary significantly depending on factors such as model, condition, rarity, and provenance. Highly coveted models like the Daytona, GMT-Master, Submariner, and Sea-Dweller command premium prices due to their iconic status and historical significance within the Rolex collection. Prices for these sought-after models can range from tens of thousands to hundreds of thousands of pounds, with exceptional examples fetching even higher sums at auction. It seems everyone has heard of Paul Newman’s 1968 Rolex Cosmograph Dayton, which sold for £13.5m at auction.

Vintage Rolex watch prices span a broad spectrum, catering to various budgets and preferences. From affordable entry-level options to high-end collectable pieces, the vintage Rolex market offers something for every discerning collector or investor.

Factors influencing vintage Rolex prices

A multitude of factors influences vintage Rolex watch prices, each contributing to the overall value and desirability of a timepiece. Understanding these factors is crucial for collectors and investors navigating the complex vintage watch market.

Here are some key elements that influence vintage Rolex prices:

- Authenticity: Authenticity is paramount when assessing the value of a vintage Rolex watch. Buyers should ensure they purchase from reputable dealers offering solid guarantees of authenticity to avoid counterfeit or altered timepieces. At Vintage Gold Watches, we offer a lifetime authenticity guarantee on all our watches.

- Condition: The condition of a vintage Rolex watch plays a significant role in determining its price. Well-maintained watches with minimal signs of wear and original components typically command higher prices due to their collectibility and aesthetic appeal.

- Original parts: Watches with original, untouched components are highly sought after by collectors. Original dials, hands, bezels, and bracelets contribute to the authenticity and integrity of a vintage Rolex watch.

- General rarity: The rarity of a vintage Rolex model can greatly impact its price. Limited production runs, discontinued models, and unusual variants contribute to higher prices, as collectors vie for the opportunity to own a unique and coveted timepiece.

- Unusual features: Watches with unique attributes or special features often fetch premium prices in the vintage Rolex market. Rare dial configurations, special edition releases, or historical significance add to the allure and exclusivity of a timepiece, driving up demand and prices.

- Current demand: Market trends and consumer preferences influence pricing dynamics in the vintage Rolex market. Models experiencing high demand due to cultural relevance, celebrity endorsements, or fashion trends may command inflated prices, while others may see fluctuations based on shifting tastes and interests.

Tips for buying a vintage Rolex watch as an investment

When considering purchasing a vintage Rolex watch as an investment, it’s essential to consider several factors to ensure you make a sound and informed decision. Here are some tips to guide you through the process:

- Check for authenticity: Authenticity is paramount when investing in a vintage Rolex watch. Ensure you buy from a reputable dealer who has already authenticated the watches, such as VGW, to guarantee you’re purchasing a genuine timepiece.

- Originality of key components: Pay close attention to the originality of key components such as the dial, case, and movement. Original components significantly impact the value of the watch, so verify their authenticity before making a purchase.

- Condition: The condition of the vintage Rolex watch is crucial in determining its value. Look for watches in excellent condition, as they typically command higher prices, especially if key components are original.

- Simplicity holds its value: For beginners, consider investing in a simple time-only watch rather than something too complicated. Simpler models often hold their value well and are easier to resell in the future.

- Buy the seller first: Prioritise buying from a reputable and reliable seller. Research the seller’s reputation, customer reviews, and authentication practices to ensure you’re dealing with a trustworthy source.

- Think about security: Consider how you will store and protect your vintage Rolex watch once you’ve acquired it. Investing in a secure storage solution, such as a safe or safety deposit box, can help safeguard your valuable timepiece.

- If it’s too good to be true, it probably is: Exercise caution and trust your instincts. If a deal seems too good to be true or the price is significantly lower than market value, it could be a sign of potential issues with authenticity or condition.

By following these tips, you can navigate the vintage Rolex market with confidence, ensuring you make a well-informed investment that will provide both financial returns and personal enjoyment for years to come.

Which Rolex models should I invest in?

Thinking about investing in a vintage Rolex watch? While the allure of hefty financial returns is certainly undeniable, don’t overlook the personal connection. After all, it’s you who’ll be wearing your Rolex paccxroudly on your wrist.

Here are a few ideas hand picked by our experts that we feel blend historical significance with investment potential:

1. Rolex Datejust

Debuting in 1945, the Rolex Datejust made waves in the watchmaking industry by introducing the innovative date complication in a wristwatch. Its groundbreaking design, which featured a date window at the 3 o’clock position, set a new standard for functionality and style. The Datejust quickly gained popularity among discerning collectors and distinguished individuals seeking a timepiece that seamlessly combined elegance with practicality.

Over the decades, Rolex has continually refined and updated the Datejust, introducing new materials, movements, and dial configurations while preserving its iconic silhouette. Today, vintage Datejust models are highly coveted for their timeless aesthetics, technical prowess, and investment potential.

This Rolex Oyster Perpetual Datejust Ref.1605 1955 is an exceptional example of a mid-1950s Datejust. Features like its sought-after early fluted bezel and restored ‘Sunburst’ dial combined with its overall top grade condition make it a fine investment piece.

2. Rolex Day-Date

In 1956, Rolex introduced the Day-Date, also known as the “President,” as the first wristwatch to display both the day of the week and the date in full. This groundbreaking complication, coupled with the watch’s luxurious design and craftsmanship, quickly established the Day-Date as a symbol of prestige and success.

The Day-Date quickly became the watch of choice for influential leaders, celebrities, and tastemakers around the world. Its association with power, wealth, and sophistication solidified its status as an enduring icon of horology. Vintage Day-Date models, particularly those from the 1950s and 1960s, are highly sought after by collectors for their historical significance, impeccable craftsmanship, and timeless appeal.

Here is a beautifully cared for and lightly used example of a 1963 Rolex Oyster

Perpetual Day-Date Ref.1803. Its original, unrestored and untouched ‘Sunburst’ Dial and

an immaculate lightly polished case increases its investment potential.

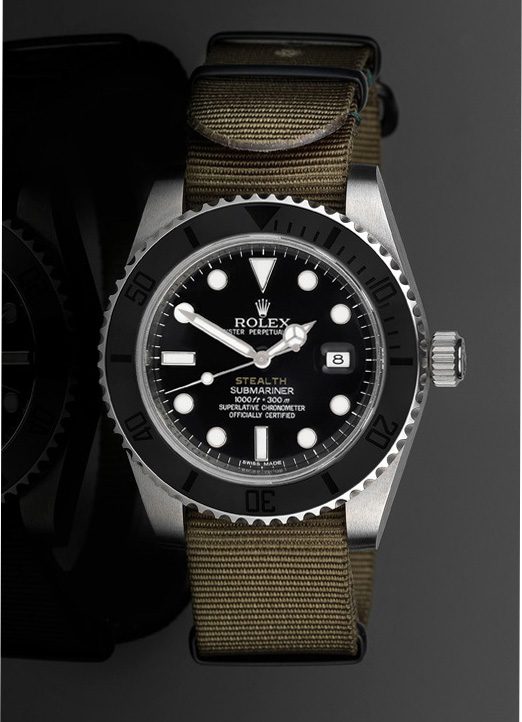

3. Rolex Submariner

Introduced in the 1950s as a dedicated diver’s watch, the Rolex Submariner quickly became an icon of sports, luxury and adventure. Its robust construction, water-resistant case, and rotating bezel marked a significant advancement in underwater timekeeping technology, earning it widespread acclaim among professional divers and enthusiasts alike.

Over the years, the Submariner’s association with exploration and rugged elegance has cemented its status as one of the most recognisable and sought-after watches in the world. Vintage Submariner models, particularly those from the 1960s and 1970s, are highly prized by collectors and investors alike.

This stunning 1957 Rolex Submariner Ref.5508 has a very rare and highly desirable exclamation dot dial. It’s unique features like this that increase a wristwatch’s investment potential.

Looking for a vintage Rolex investment piece?

If you are looking to buy a vintage Rolex, we are always happy to help. At Vintage Gold Watches, we are committed to excellence and helping people find the perfect vintage watch that reflects their style and personality. Don’t worry if the particular model you want is sold, just talk to us and we will be happy to source another fine piece for you.

Call us on 020 7727 7095 to make an appointment or shop our vintage Rolex watches.

If you’d like to stay up to date on vintage watch news and be the first to see the latest watches added to our collection, sign up for our weekly newsletter.

OTHER BLOGS